tax break refund status

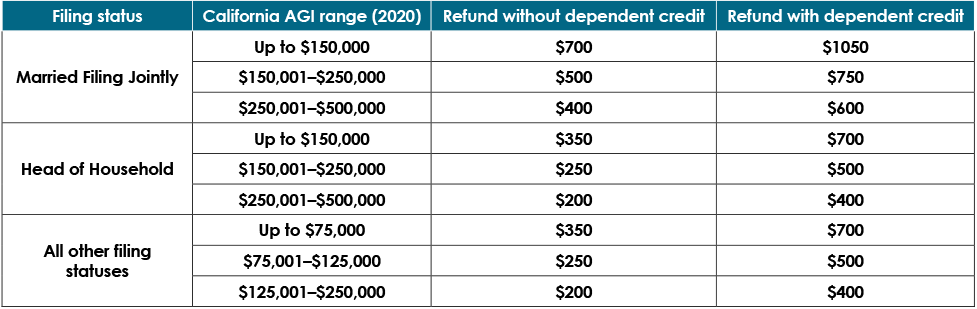

Taxpayers can view status of refund 10 days after their refund has been sent by the Assessing Officer to the Refund Banker. Head of Household filers could receive a maximum refund.

Additional New York State Child And Earned Income Tax Payments

If you submitted your tax return by mail the IRS says it could take six to eight weeks for the refund to arrive.

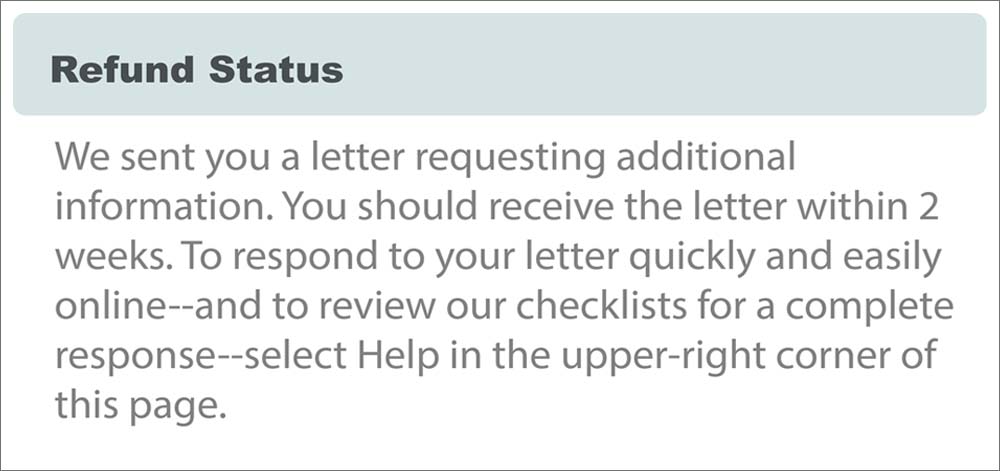

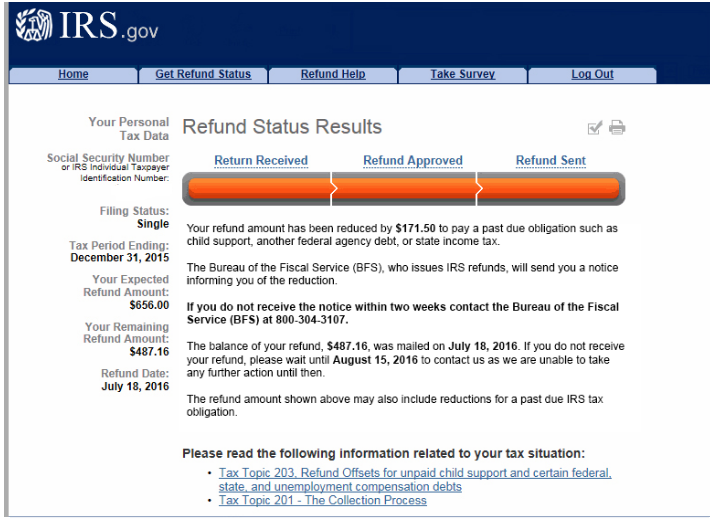

. Be sure you have a copy of your return on hand. You can check the status of your current year refund online or by calling the automated line at 260-7701 or 1-800-218-8160. An immediate way to see if the IRS processed your refund is by viewing your tax records online.

Eligible taxpayers must file by November 1 2022 to receive the rebate. Even though the chances of speaking with someone are slim you can still. Your Social Security number or Individual.

Received your 2020 tax refund by direct deposit but have since changed your banking institution or bank. 1-800-323-4400 or 609-826-4400 anywhere for our automated refund system. If you havent received it.

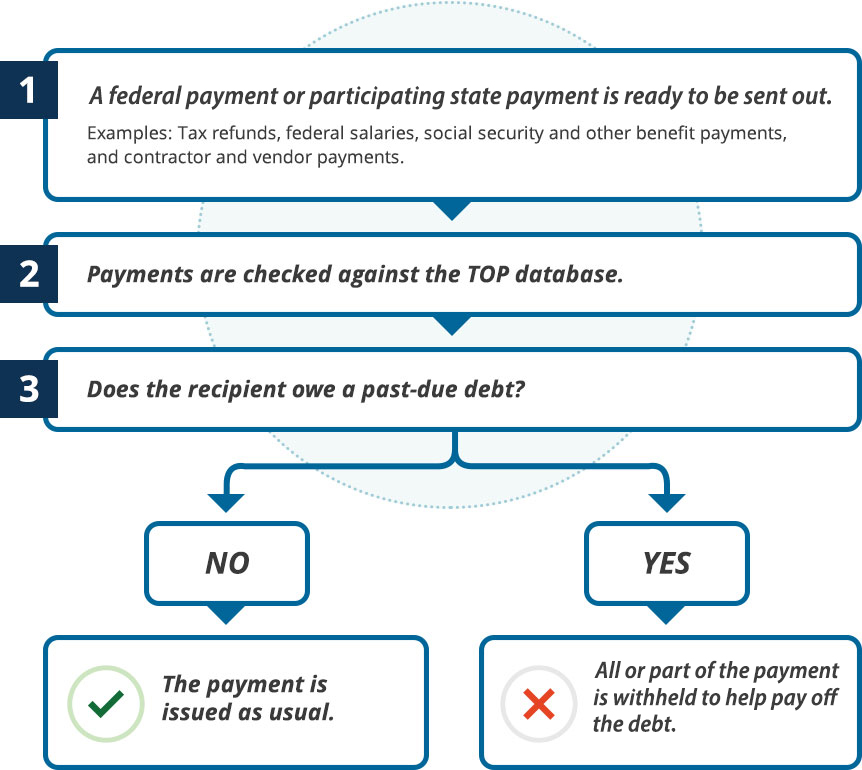

Status of paid refund being paid other than. The amounts are based on the most recent approved 2020 tax return information on file at the time we issue the rebates. Using the IRS Wheres My Refund tool Viewing your IRS account information.

It depends on your filing status. You can also request a copy of your transcript by mail or through the IRS. The agency is juggling the tax return backlog delayed stimulus checks and child tax credit payments.

Tracing a Refund Check Thats Gone Missing. To check the status of your 2021 income tax refund using the IRS tracker tools youll need to provide some personal information. Single filers and married individuals who file separately could receive a maximum refund of 250.

Theres a process in place in case you lose your paper check or if it goes missing. 4 weeks or more after you file. You can ask the IRS to trace it by calling 800.

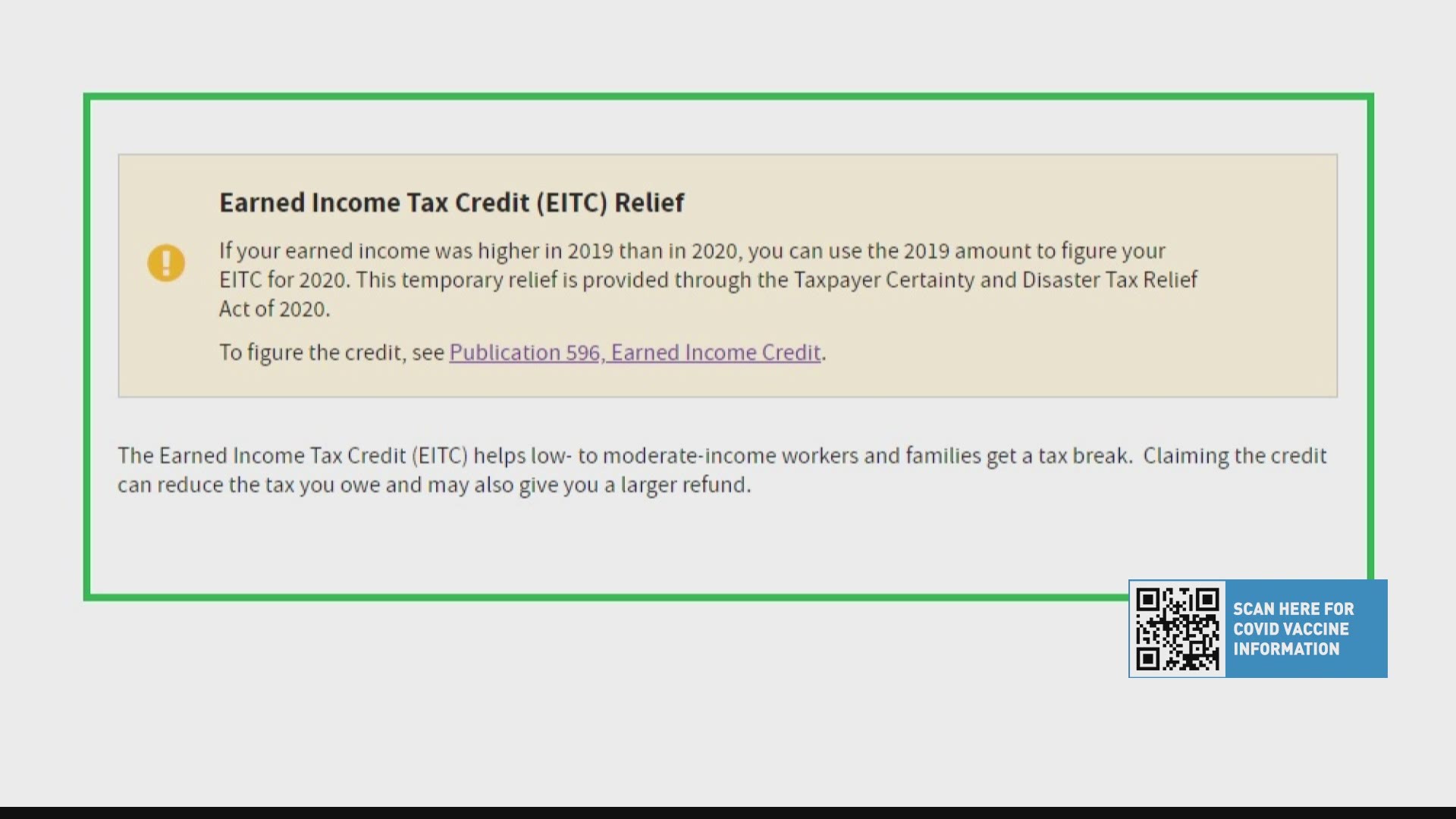

Amount of the 2022 Special Session rebate whichever. Additionally your tax refund could be delayed for a number of. When it went into effect on March 11 2021 the American Rescue Plan Act gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020.

If youre eligible and filed by September 5 we have already issued your rebate. Received your tax refund by check regardless of filing method. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by.

When can I start checking my refund status.

2022 State Of Illinois Tax Rebates 2022 Illinois Tax Rebates

Over 7 Million Americans Could Receive Refund For 10 200 Unemployment Tax Break

Tax Refunds And Relief In The 2022 Ca Budget Deal Grimbleby Coleman Cpas Modesto California

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

How To Get Maximum Tax Refund If You File Taxes Yourself Parade Entertainment Recipes Health Life Holidays

Cash App Taxes 100 Free Tax Filing For Federal State

How To Determine Federal Tax Refund Status Tax Relief Center

Where S My Federal Tax Refund Credit Karma

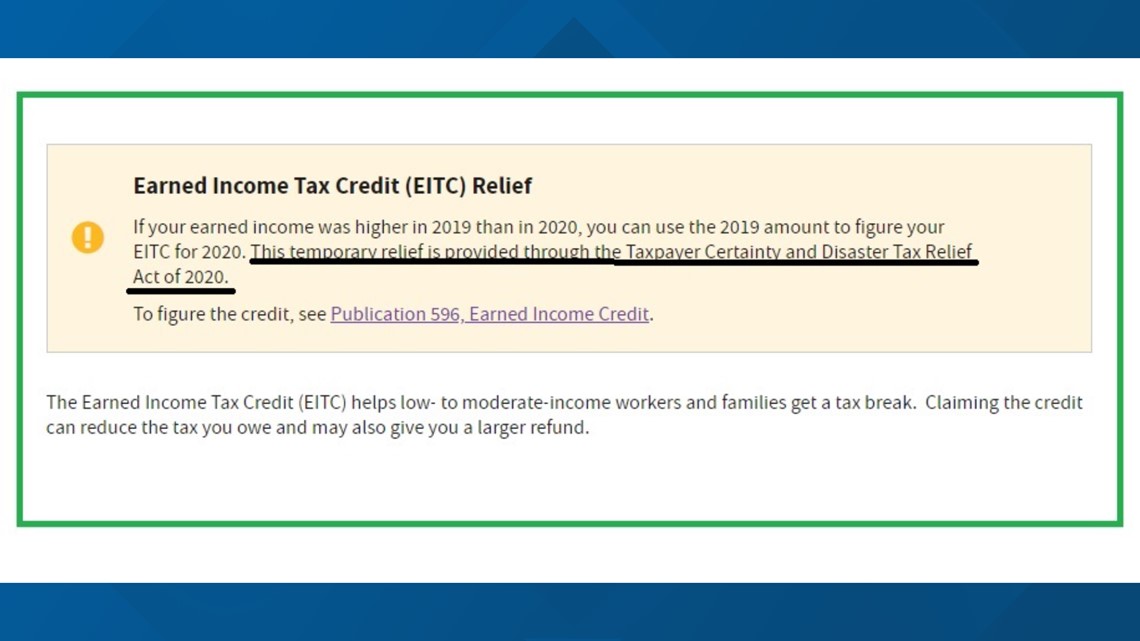

Get A Bigger Refund With The Earned Income Tax Credit Eitc Wfmynews2 Com

The Irs Is Sending Special Refunds To 1 6 Million Taxpayers Money

Refund Status Your Tax Return Is Still Being Processed And Refund Date To Be Provided Why And How Returns With Errors Are Being Handled By The Irs Aving To Invest

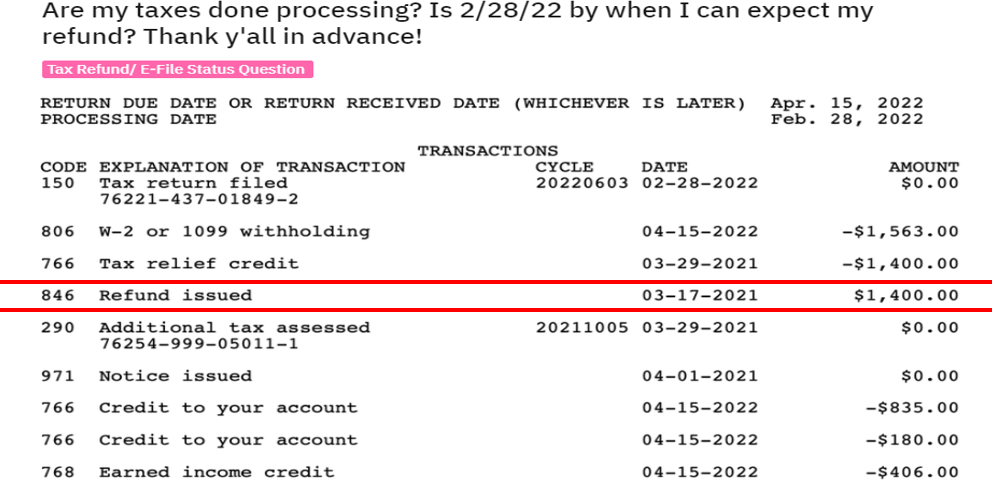

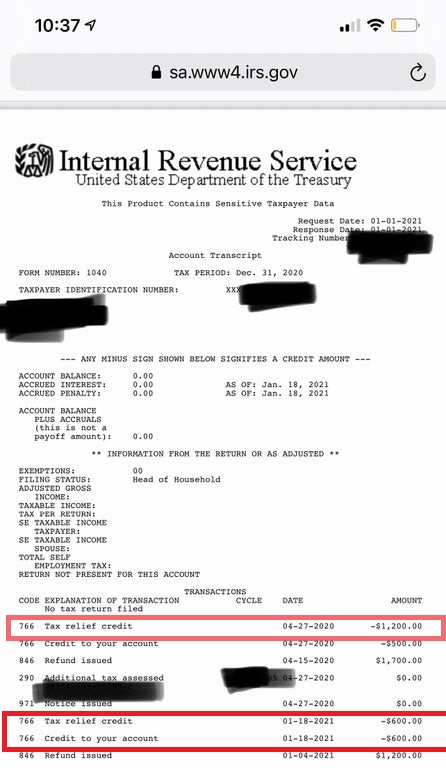

Will My Irs Tax Transcript Help Me Find Out When I Ll Get My Refund And What Does It Mean When Transcript Says N A Aving To Invest

United States Is My Tax Return Refund Unsually Late Personal Finance Money Stack Exchange

The Irs Just Sent More Unemployment Tax Refund Checks Kiplinger

Get A Bigger Refund With The Earned Income Tax Credit Eitc Wfmynews2 Com

Where S Your Tax Refund Find Out With Irs Online Tracker Don T Mess With Taxes

Why Is It Taking So Long To Get My Tax Refund Irs Processing Backlog Updates Aving To Invest